Wednesday, November 21, 2012

Happy Thanksgiving

For more information, contact Elite Bookkeeping & Tax Services at (800) 416-3820 or (775) 884-6188 Address: 123 West Nye Lane, Suite 103, Carson City, NV 89706. Visit our website at www.elitebookkeeping.biz

Wednesday, October 10, 2012

Winning the Tax Game- End of the Season Tax Tips

If you think gridlock is a football term, you may not be too far out of bounds. Tax cuts, tax increases and tax provisions are being passed back and forth in Washington, D. C. and whoever fumbles, loses. That can be bad news for taxpayers.

Look at what hangs in the balance: Lower tax rates, the 15% capital gains rate on long-term investments, the 2% payroll tax cut, the 35% maximum estate and gift tax rates, direct IRA payouts to charity, higher alternative minimum tax exemptions, the deduction for state sales taxes and even the $250 deduction for out-of-pocket teacher supplies. And you thought the potential for a 2012 catastrophe was only a Mayan myth.

Although we may be down to the final quarter of the year, there is still time before the two-minute warning, to take a look at your tax situation and see if you can save a few tax dollars.

• The American Opportunity Tax Credit expanded the Hope Credit, providing a credit of up to $2,500 of the cost of qualified tuition and related expenses. Up to $1,000 of the credit can be returned to a taxpayer as a refund. The credit was supposed to end in 2010, but it was extended through 2012. This could be the credit's last year if Congress is looking for ways to cut the federal deficit.

• If you’re in the top tax bracket of 35%, you may want to accelerate income into 2012, if possible. If Congress doesn't act, the highest tax rate will rise to 39.6% in 2013.

• Along with the possibility of higher ordinary income tax rates, there's the possibility of higher capital gains rates on investment income in 2013. The top capital gains rate for investments held for more than a year is 15% for most taxpayers through 2012, and zero capital gains tax for investors in the 10% and 15% tax brackets. If your crystal ball says capital gains taxes are going up next year, you may want to consider locking in profits on long-term investments before the end of this year.

• Giving to charity can help reduce your tax bill if you are able to itemize deductions. In addition to contributions made by cash, check or credit card, the crisp fall air may provide the energy, while the potential of a lower tax bill may provide the incentive to clean out closets looking for items in good condition, that you can donate to a qualified charitable organization. Remember to make a list of the items and determine their fair market value. Clip the list to the door hangar or receipt that you receive from the organization and keep with your tax return documents for your records.

• If you believe that charity begins at home and you want to give away your estate's assets while you're still around to get thanks, you can give up to $13,000 each to as many individuals as you wish without any tax costs to you or your gift recipients in 2012.

• Sometimes, a major life change is thrown your way and you may not think of it as a tax deduction. If you found yourself looking for a new job, agency fees, resume expenses, career counseling costs and travel related to the job search may be deductible even if the job search was unsuccessful.

If you moved because of a change in job location, the cost of moving your household goods and family members may be deductible.

Unreimbursed travel expenses for military reservists, including the National Guard, may be deductible.

The fee that you pay for renting a safe-deposit box, the cost of having your taxes prepared, the advisory or management fees you pay a firm to manage your investments may also be overlooked deductions.

Some of these tax breaks require you to itemize. Others are available even if you claim the standard deduction. Naturally, there may be eligibility requirements to meet and in some cases, there will be extra worksheets, forms or schedules. And you will always need to have documentation for these often-overlooked deductions.

• Even if you’re thinking you’ll never be able to retire, putting money into a retirement account can save you tax dollars. Employees should contribute as much as they can to their 401(k) or similar plans at work.

If you’re eligible, you may want to contribute to an Individual Retirement Account (IRA). Although Roth IRA contributions are not deductible, traditional IRA contributions may be, depending on your income and whether or not you are covered by an employer’s plan.

Self-employed folks also have a variety of retirement plans from which to choose: SEP (Simplified Employee Pension) IRA, or Solo 401(k) or SIMPLE (Savings Incentive Match Plan for Employees) IRA. Some taxpayers may be able to contribute to a Traditional IRA.

For 2012, remember Roth IRA conversion taxes! If you converted a traditional IRA to a Roth IRA in 2010, you were allowed to span the taxes due on the converted amounts equally over the 2011 and 2012 tax years. Your first Roth conversion tax bill was included on your 2011 return, but make sure you plan for the 2012 conversion bill.

Along those lines, it is not too late to adjust the amount of Federal or state tax withheld from your paycheck. If you owed taxes last year, or received a larger refund than expected, you may want to take a look at adjusting your withholding. Remember: the goal is to pay the least amount of taxes. The final quarter of the year is the perfect time to talk to your Enrolled Agent to make sure the game plan you discussed at the beginning of the year still applies, and you’ll surely be the winner at tax time.

For more information, contact Elite Bookkeeping & Tax Services at (800) 416-3820 or (775) 884-6188 Address: 123 West Nye Lane, Suite 103, Carson City, NV 89706. Visit our website at www.elitebookkeeping.biz

Thursday, September 13, 2012

Tax Benefits of Medical and Dental Reimbursement Plan

UTILIZATION OF THE TAX BENEFITS AFFORDED BY A MEDICAL AND DENTAL REIMBURSEMENT PLAN

In recent years one of the more common tax benefits utilized by closely held corporations was the Executive Medical and Dental Reimbursement Plan (Section 105(h) of the Internal Revenue Code). Section 89 of the Internal Revenue Code enacted by the Tax Reform Act of 1986 would have repealed section 105(h) and replaced it with a more complex set of rules. Congress repealed Section 89 in 1989 and reinstated Section 105(h). The plan must meet certain eligibility and benefits requirements, otherwise the plan is deemed discriminatory, and all (or a portion) of the benefits paid thereunder would be included in the gross income of the employees so benefited.

Eligibility Requirements

A plan satisfies the nondiscriminatory eligibility requirements if it meets either of two standards, which are similar to the nondiscriminatory eligibility requirements applicable to pension plans prior to revision of the 1986 Tax Reform Act. Under the first alternative eligibility standard, a plan must benefit at least 70% of all employees (or 80% percent of all employees if at least 70% percent of the employees are eligible). Under the second alternative eligibility standard, a plan must benefit a classification of employees set up by the employer and found by the Secretary of the Treasurer not to be discriminatory in favor of employees who are highly compensated individuals. In applying the alternative eligibility standards, the act provides that there may be excluded from consideration any employee who: (1) has not completed 3 years of service, (2) has not attained the age of 25, or (3) is a part time or seasonal employee.

In addition, employees in a collective bargaining unit can be excluded from consideration under the rules similar to those provided for qualified pension plans if there is evidence that accident and health benefits were the subject of good faith bargaining. Similarly, the Act provides for the exclusion of nonresident aliens, under pension plan rules.

Benefit Requirements

The act further provides that benefits must not discriminate in favor of employees who are highly compensated individuals. A plan does not meet the requirement of nondiscriminatory benefits unless all benefits provided for employees who are highly compensated individuals are also provided for all other employees. In testing plan benefits for discrimination, all facts and circumstances are to be taken into account. Consequently, if a plan, or a particular benefit provided by a plan, is terminated, the termination would cause plan benefits to be discriminatory if the limited duration of the plan or benefit has the effect of discrimination in favor of the highly compensated. This situation could arise, for example, where the duration of a particular benefit roughly coincides with the period during which a highly compensated employee utilizes that benefit. The requirements of the act are not violated merely because benefits under an employers plan are offset by benefits paid under a self-insured or insured plan of the employer or another employer, or by benefits paid under Medicare or Federal or State law.

Highly Compensated Employee

A highly compensated employee is: (1) one of the five highest paid Officers, (2) a Shareholder (owning more than 10 percent of stock, directly or indirectly), or (3) one of the highest paid 25% of all employees (other than employees who may be excluded from consideration).

Excess Reimbursement

Excess reimbursement to a highly compensated employee during a plan year under a self-insured medical reimbursement plan is included in the gross income of the employee for the taxable year in which the plan years ends. Reimbursement is an excess reimbursement if it is a discriminatory benefit, that is, if it made under a plan benefit which is provided for an employee who is highly compensated, but not to all employees who are not highly compensated.

In addition, a portion of the total amount reimbursed during a plan year to each employee who is highly compensated is an excess reimbursement if the plan does not meet the nondiscriminatory eligibility requirements. The excess reimbursement portion is determined by multiplying the total amount reimbursed to the employee during the plan year by a fraction, the numerator of which is the total amount reimbursed during that year to all employees who are highly compensated and the denominator of which is the total amount during that year to all employees. In computing the amount of an excess reimbursement because a plan does not meet the nondiscriminatory eligibility requirements, however, discriminatory benefits are not taken into account.

Regulations promulgated by the Secretary of the Treasury provide that reimbursements for certain medical diagnostic procedures do not have to be considered part of a plan, and are not subject to the nondiscrimination requirements of Section 105(h). Included with your new Corporate Kit is a copy of a plan together with a special set of minutes adopting the plan. To set the plan in operation, the papers need only be completed.

For more information, contact Elite Bookkeeping & Tax Services at (800) 416-3820 or (775) 884-6188 Address: 123 West Nye Lane, Suite 103, Carson City, NV 89706. Visit our website at www.elitebookkeeping.biz

Wednesday, September 12, 2012

Tax Relief for Victims of Hurricane Isaac

IRS Provides Tax Relief to Victims of Hurricane Isaac; Return filing and Tax Payment Deadline Extended to Jan. 11, 2013

The Internal Revenue Service is providing tax relief to individuals and businesses affected by Hurricane Isaac.

Following recent disaster declarations for individual assistance issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in Louisiana and Mississippi will receive tax relief, and other locations may be added in coming days based on additional damage assessments by FEMA.

Click here for more information

For more information, contact Elite Bookkeeping & Tax Services at (800) 416-3820 or (775) 884-6188 Address: 123 West Nye Lane, Suite 103, Carson City, NV 89706. Visit our website at www.elitebookkeeping.biz

The Internal Revenue Service is providing tax relief to individuals and businesses affected by Hurricane Isaac.

Following recent disaster declarations for individual assistance issued by the Federal Emergency Management Agency, the IRS announced today that affected taxpayers in Louisiana and Mississippi will receive tax relief, and other locations may be added in coming days based on additional damage assessments by FEMA.

Click here for more information

For more information, contact Elite Bookkeeping & Tax Services at (800) 416-3820 or (775) 884-6188 Address: 123 West Nye Lane, Suite 103, Carson City, NV 89706. Visit our website at www.elitebookkeeping.biz

Monday, September 10, 2012

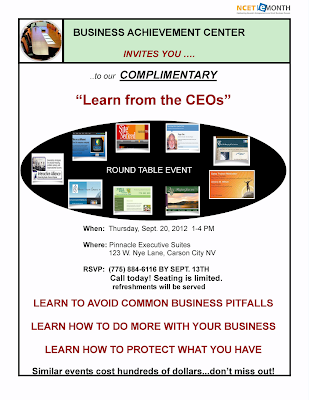

Learn from the CEOs

We are one of the guest speakers at this complimentary event by the Business Achievement Center. Don't miss out! Seating is limited so call today to reserve a spot.

For more information, contact Elite Bookkeeping & Tax Services at (800) 416-3820 or (775) 884-6188 Address: 123 West Nye Lane, Suite 103, Carson City, NV 89706. Visit our website at www.elitebookkeeping.biz

Tuesday, June 26, 2012

Ten Tips for Business Success

Running a business, a department and a home are so complex, with so many people and government agencies pulling on you from all directions. With all the endless reports and duties, it’s amazing that anyone is actually able to get work done, to produce a product finish a project and raise a family. Yet, we do, don’t we? And we do it well.

In a workshop conducted for executive women, the universal complaint was their days were so full of interruptions that these women couldn’t get their own work done. By the end of the workshop, they had come to realize – the interruptions are the job. To manage interruptions and make your life less taxing, here are some guidelines.

- Know what you want. Whether in life or business, have a goal. Have you ever seen people who seem to always get what they want? When the opportunity presents itself, they know what to ask for – and don’t hesitate to ask.

- Have a plan. When outlining the steps to reach your goal, you’ll actually take those steps. It feels so good to cross off each step as you go along. Besides business plans can really save your hide when you get audited.

- Care. Care about the people who live with you, work for you, with you, supply you and pay you. When you treat people well; when you listen to them; when you make each person feel they have 100% of your attention when it matters – you’ll have earned powerful loyalty, respect and love.

- Know things. Learn the things you need to know to reach your goals so you never have to rely on others. In a pinch, or on deadline, you can step in to do the task, or quickly train someone to do it.

- Delegate. Once you know the things you must know to run your business or project, hire the right people to do those things you prefer not to do. If you have any doubts before hiring them – keep looking.

- Market yourself with finesse – not aggressiveness. Whatever you do, you’re always selling – whether it’s yourself, your company, your product, your services, or your ideas and passions. Don’t be overly modest. Learn to express your ideas or pitches succinctly and effectively.

- Go to the top. Start with the president, CEO, or the person with the decision-making authority, at the company you want to pitch. To get past their executive assistants, just tell the assistant what you want to accomplish. Make the assistants your allies. They not only have the ear of the top boss – but also influence all the executives’ assistants. Let the boss and his/her aide introduce you to their operations executives or managers.

- Don’t waste your advertising budget on big ticket, splashy ads unless you have unlimited funds. Those are good for the moment only. Use your budget and your customers’ word-of-mouth to establish a constant, visible presence.

- Keep great records and comply with all government requirements – all levels. Not only will this make audits easier and give you information to keep your costs under control, good records reduce your taxes,

- Have no competitors. Everyone in your industry does something just a little differently. So when someone else is a better choice for your customer or client – refer them. In fact, make the introduction. You’ll generate good will all around.

BONUS – Number 11. Never stint on quality. Make each product or project as important the 100th time as it was the first time.

For more information, contact Elite Bookkeeping & Tax Services at (800) 416-3820 or (775) 884-6188 Address: 123 West Nye Lane, Suite 103, Carson City, NV 89706. Visit our website at http://www.elitebookkeeping.biz/

Subscribe to:

Posts (Atom)